personal property tax car richmond va

Ad Get Record Information From 2022 About Any County Property. Vehicles with a weight of 10000 pounds or less registered in VA but normally garaged docked or parked in another state shall be taxed in the VA locality where the vehicle is registered Refer to Code of Virginia 581-3511.

/cloudfront-us-east-1.images.arcpublishing.com/gray/WPM3BLSOYBGB7DP3Q4DS2QXRUU.png)

Chesterfield Provides Grace Period On Personal Property Tax Payments

Is more than 50 of the vehicles annual mileage used as a business.

. Personal property tax relief provides tax relief for any passenger car motorcycle pickup or panel truck having a registered gross weight of less than 10001 pounds. Search For Title Tax Pre-Foreclosure Info Today. WWBT - If you live in Chesterfield County you may have noticed a spike in personal property taxes especially when it comes to your car.

VA 22334-0899 Any vehicle owner paying by check or money order should write the account number in the memo field. At the calculated PPTRA rate of 30 you would be required to pay. How do I update my records with the Commissioner of Revenue office regarding personal property taxes for my vehicle.

WRIC Richmond residents will have an extra two months to pay their personal property taxes after the City Council voted to extend the. Vehicle Taxes Real Estate Tax Relief Treasurer. Broad Street Richmond VA 23219.

Invoice Cloud is a convenient payment option for paying real estate taxes and motor vehicle personal property taxes include creditdebit cards e-checks scheduled payments and automatic payments Auto-Pay. If you can answer YES to any of the following questions your vehicle is considered by state law to have a business use and does NOT qualify for personal property tax relief. Personal Property Tax also known as a car tax is a tax on tangible property - ie property that can be touched and moved such as a car or piece of equipment.

Jun 1 2022 0608 PM EDT. WWBT - As Richmond residents see an increase in their personal property tax bills Richmond City Council has extended the due date for the payments. If your vehicle is valued at 18030 the total tax would be 667.

It is an ad valorem tax meaning the tax amount is set according to the value of the property. Be Your Own Property Detective. Involving Richmond police vehicle.

Personal property taxes on automobiles trucks motorcycles low speed vehicles and motor homes are prorated monthly. Monday - Friday 8am -. Returned checks are subject.

Answer the following questions to determine if your vehicle qualifies for personal property tax relief. If you have questions about your personal property bill or. Enter Any Address to Start.

Our office is bound by VA Code regarding. The county also can consider high mileage and damage beyond regular wear and tear in assigning values to vehicles. Boats trailers and airplanes are not prorated.

Learn About Property Value Taxes Sales History More. Personal Property Taxes are billed once a year with a December 5 th due date. An example provided by the City of Richmond goes like this.

In neighboring Henrico County where personal property tax rates are the lowest in the Richmond area at 350 per 100 assessed value leaders have proposed using a newly amended Virginia law that. The vehicle must be owned or leased by an individual and NOT used for. The Commissioner of the Revenue is responsible for assessing personal property taxes VA Code Sec 581-3100-31231.

Avoid Costly Mistakes with Professional-looking Legible and Error-free Legal Forms. TAX RELIEF FOR THE ELDERLY AND DISABLED - REAL ESTATE. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as of January 1 st of each tax year.

Personal Property Tax is responsible for the assessment of all vehicles cars trucks buses motorcycles boats and motor homes that are taxable in the City of Alexandria. In addition Henrico maintains a personal property tax rate for vehicles of 350 per 100 of assessed value which is the lowest among major localities in the region. Box 124 Chesterfield VA 23832.

As of December 31 st of the year preceding the tax year for which assistance is requested the. Search Any Address 2. What seems a large increase in value may actually turn into a tiny increase in your property tax bill.

Board of Supervisors Approves 15 Tax Relief on Personal Property Taxes Vehicle values climbed by an average of 33 or more as of Jan 1 2022 according to the JD. Ad Browse Legal Forms by Category Fill Out E-Sign Share It Online. Motor Vehicle Personal Property Motor vehicle personal property includes vehicles boats trailers and motorcycles.

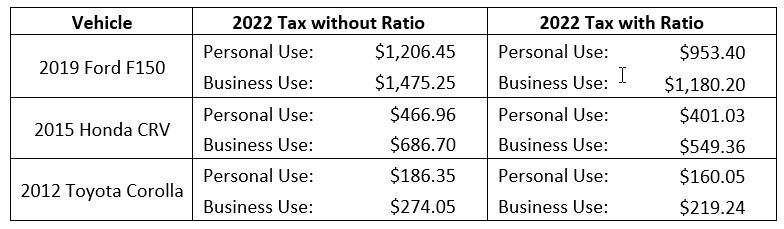

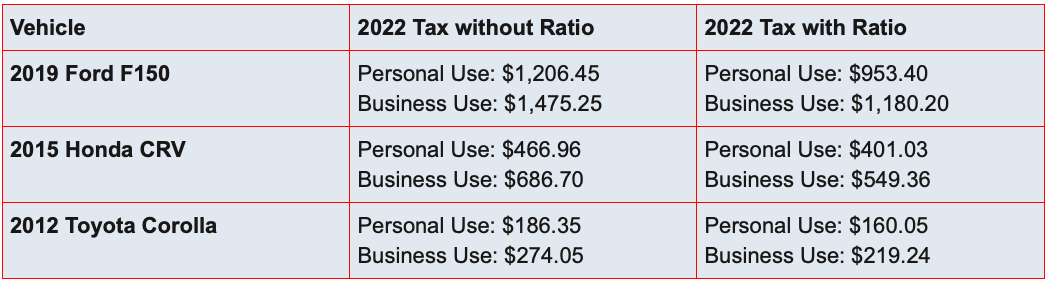

On Tuesday the council voted. To help vehicle owners the Fairfax County Board of Supervisors approved 15 tax relief for personal property taxes as part of their FY 2023 budget markup. The property owner must be at least 65 years of age or determined to be permanently or totally disabled by December 31 st of the year preceding the year for which assistance in required.

Personal Property Registration Form. The Motor Vehicle Personal Property Return Form will be mailed to you in early March and must be returned to our office no later than May 1. Register your vehicle in your new state and forward a copy of either the title or registration to our office by.

Thoroughly determine your actual property tax applying any exemptions that you are allowed to have. My office has used the same assessment methodology for at least 35 years. The 2022 tax rate for personal property in King George County is 325 per 100 of the assessed value.

Many residents called 12 On Your Side and. See Property Records Tax Titles Owner Info More. Protesting your propertys tax valuation is your right.

Before you do look at what the assessment actually does to your yearly tax payment. Team Papergov 1 year ago. BOB BROWN Passengers board southbound Amtrak train 91 at the Staples Mill Amtrak station in Richmond VA Monday March 19 2018.

Personal Property is taxable in the locality where it is normally garaged docked or parked.

Virginia Sales Tax On Cars Everything You Need To Know

Virginia S Personal Property Taxes On The Rise 13newsnow Com

Virginia S Personal Property Taxes On The Rise 13newsnow Com

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

Virginia S Personal Property Taxes On The Rise 13newsnow Com

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

With Used Car Values Up Some Northern Virginians Get Car Tax Relief Wtop News

Henrico County Announces Plans On Personal Property Tax Relief

Many Left Frustrated As Personal Property Tax Bills Increase

Henrico County Announces Plans On Personal Property Tax Relief

Virginia Localities Pushing Tax Relief As Car Values Go Up Dcist

Nestiny Funiversity Specialty Inspections Available To Buyers And How To Know If You Need One

What To Know About U S Electric Car Tax Credits And Rebates Bloomberg

Frustrations Rise In Henrico As Personal Property Tax Bills Increase

City Cuts Tax Bills On Vehicles 20 Percent Richmond Free Press Serving The African American Community In Richmond Va

Richmond Extends Deadline To Pay Personal Property Taxes Wric Abc 8news